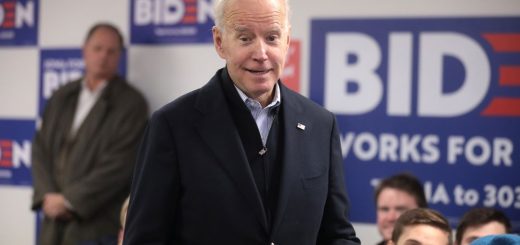

Joe Biden saw one ugly number that could be the final nail in his coffin

Joe Biden’s trying to mount a comeback in the Presidential election.

But he got hit with some really bad news.

Now Joe Biden saw one ugly number that could be the final nail in his coffin.

Inflation climbs higher than expected

The Consumer Price Index (CPI) surged 3.4% year-over-year from last March.

Princes also jumped 0.4% from February.

Last month, inflation rose 3.2% giving Democrats hope that the secretive and unaccountable Federal Reserve would cut interest rates at their June meeting.

A rate cut would loosen the money supply and lead to an economic surge heading into the home stretch of the election.

Prior to this report, Fed Chairman Jay Powell sounded unsure if the Fed would cut rates in June as he was looking for indicators inflation was nudging down toward the target rate of two percent.

“It is too soon to say whether the recent readings represent more than just a bump,” Powell stated. “We do not expect that it will be appropriate to lower our policy rate until we have greater confidence that inflation is moving sustainably down toward two percent.”

The March inflation surge all but eliminates any chance of a June rate cut and that means President Joe Biden will face the voters running into the headwind of a sluggish economy.

Higher inflation is Biden’s fault

Research fellow at the Heritage Foundation’s Grover M. Hermann Center for the Federal Budget E.J. Antoni explained in an interview with the Daily Caller that inflation is actually worse than the numbers show.

“Indexes like the median CPI and trimmed-mean CPI remove outliers and they show inflation much higher than the headline, or even the core, inflation rates,” Antoni explained. “That tells us the rise in prices is widespread and not simply one or two volatile components jumping for a few months. We’re facing persistently high inflation — period.”

Antoni added that Biden’s trillions in new spending are forcing the Fed to expand the money supply to finance deficit spending.

The Fed – Antoni added – is making matters worse keeping interest rates too low and allowing America’s fiscal house to remain a wreck.

“The FYTD deficit is an annualized $2.8 trillion, much higher than estimates by the Treasury, CBO, or OMB,” Antoni added. “To pay for these unfunded bills, the Federal Reserve has allowed bank reserves to climb more than 20% from their trough last year, which is fueling inflation by growing the money supply. Rate cuts should be off the table, the balance sheet runoff should be accelerated, and interest rates should be allowed to float higher, instead of being set at today’s artificially low level.”

Former President Donald Trump holds a small, but steady lead in both national and swing state polls.

The economy and inflation are the top issues for voters other than immigration.

Polls show he leads Biden by as many as 35 points on the border.

These same polls also show him leading Biden on the economy and dealing with inflation.

If inflation continues to run hot through the summer Biden won’t be able to make up ground on the economy and it could hand Trump the election.